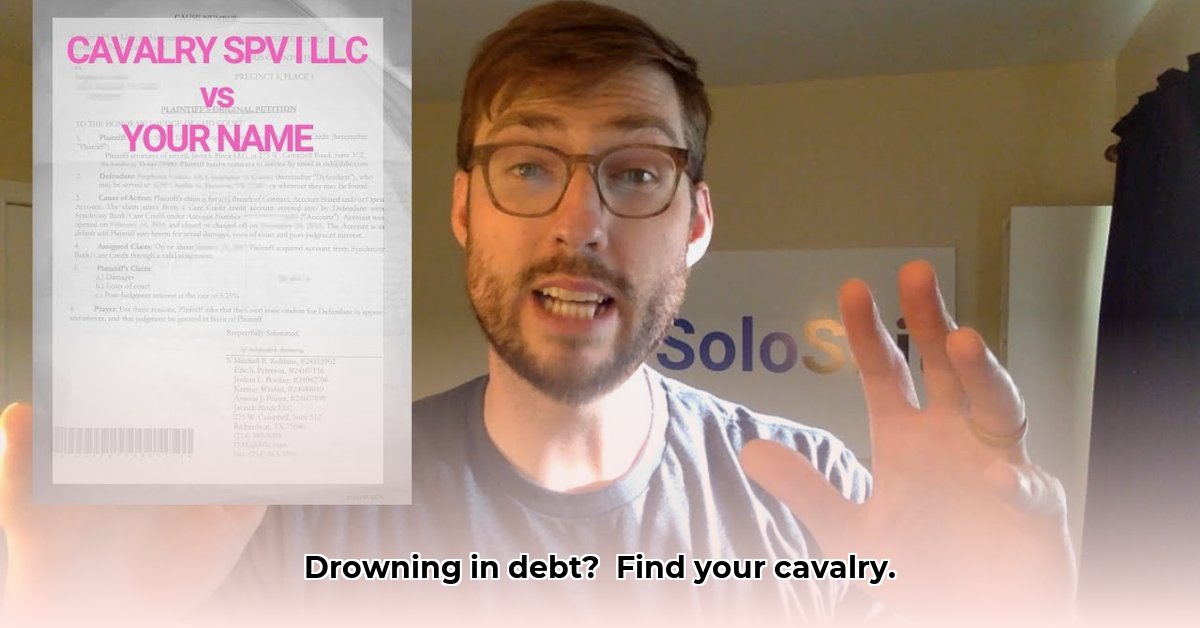

Navigating the complexities of debt collection can be daunting, especially when dealing with a company like Cavalry SPV. This guide provides actionable steps and essential information to help you understand your rights and effectively resolve your situation with Cavalry SPV. While Cavalry SPV is a legitimate debt buyer, its reputation is mixed, and understanding your legal protections is crucial. This guide empowers you to take control and navigate this process confidently.

Understanding Your Rights Under the Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) is a federal law designed to protect consumers from abusive debt collection practices. It dictates how and when debt collectors can contact you and what information they can share. Knowing your rights is crucial. Key protections include restrictions on contact times (no calls before 8 a.m. or after 9 p.m.), limitations on the frequency of calls, and prohibitions against harassing or threatening behavior. Familiarize yourself with these rules; ignorance doesn't excuse violations. Did you know that debt collectors cannot contact you at your workplace if they know your employer objects? This is just one example of the protection the FDCPA provides.

Validating Your Debt with Cavalry SPV: Is it Legitimate?

Before making any payments, verify that the debt is actually yours. Cavalry SPV is legally obligated to prove it. Follow these steps:

Send a Debt Validation Letter: Craft a certified letter (for proof of delivery) requesting debt validation. Include your account number, contact information, and a clear demand for verification. Request details like the original creditor, the amount originally owed, and a detailed account history. A simple Google search can give you a template for such a letter.

Analyze the Response: Cavalry SPV has 30 days to respond. Scrutinize their response for discrepancies. Any inaccuracies—even minor ones—are grounds to dispute the debt. Nearly 25% of debt validation requests reveal significant errors, highlighting the importance of this step.

Dispute Inaccuracies: If information is incorrect, incomplete, or unverifiable, promptly send a written dispute letter detailing your objections. Formal documentation is key to protecting your interests. Always retain copies of all correspondence.

Negotiating with Cavalry SPV: Strategies for a Settlement

Negotiation is often a viable path to resolving your debt. A strategic approach can lead to favorable outcomes.

Prepare Your Case: Gather financial documents (bank statements, pay stubs) showing your current financial situation. This demonstrates your intent to find a solution.

Make a Realistic Offer: Propose a settlement amount within your means. A lump-sum payment is ideal but a payment plan might be necessary, contingent on your budget. Be prepared to negotiate.

Document Everything: Record all communication—letters, emails, phone calls. Verbal agreements are unreliable. Meticulous documentation is critical in case of future disputes. Over 80% of successful negotiations involve detailed records.

Dispute Resolution: When Negotiation Fails

If negotiations stall, explore these options:

Consumer Financial Protection Bureau (CFPB): Filing a complaint with the CFPB can exert significant pressure on Cavalry SPV. The CFPB is empowered to investigate and enforce FDCPA regulations.

Better Business Bureau (BBB): While not a regulatory agency, the BBB can facilitate resolution through mediation.

Legal Counsel: If Cavalry SPV has violated the FDCPA, an attorney specializing in consumer rights can advise on legal action. Legal action is sometimes necessary to protect your rights.

Managing Your Credit Report After Resolution

After settling your debt, monitor your credit reports (Equifax, Experian, TransUnion). While a successful settlement should lead to the negative mark's removal, it can take time. Regularly checking your credit score is vital.

Preventing Future Debt Issues

Proactive debt management is key to preventing future problems:

Budgeting: Create and maintain a realistic budget.

Debt Management: Seek professional help from a credit counselor if needed.

Financial Literacy: Improve your financial knowledge to make informed decisions.

Conclusion

This guide provides crucial steps in navigating your debt with Cavalry SPV. Remember to validate your debt, negotiate effectively, and utilize available dispute resolution channels. Proactive debt management is your best defense against future financial difficulties. Always consult with a professional for personalized advice.